Tackle Today: Physics & Central Banks

December 5, 2019

« The price of envy. »

As described in yesterday’s article (read it here), the main purpose of Physics is to understand how the Universe behaves by studying the matter, its motion, energy and force, and its behavior through space and time.

Then we have economists. Envious as they are of physicists, they simply do not care about the “obsolete” Austrian School and their “human behavior nonsense”. Simplicity is for Da Vinci and Steve Jobs; they want complexity.

Although there were various statements added by physicists during the centuries, the Second Law of Thermodynamics states, in its simplest form, that an isolated system becomes more complex as more energy is added to it. This is an irreversible course as the arrow of time moves only forward and, as it proceeds and more energy is further added, the more complex and disordered the system becomes. Entropy never decreases over time and the system’s original state is forever lost. In such systems, particles have no “future memory”, so everything in the future is pure conjecture.

Then we have Central Banks with their economists and policymakers. The tools they used—and are still using—to stabilize the world’s economy after the fateful market crash of 2008 added energy and complexity to a system that was already too complex and damaged.

Because the particles in this system have no “future memory”, we can’t predict what is going to happen. The path that lies ahead is opaque.

More liquidity is added, negative interest rates spread like a disease and long strategies craving for easy money push the market to new highs. The system’s entropy only increases; the original state is forever lost.

The arrow of time and envy move only forward, never back.

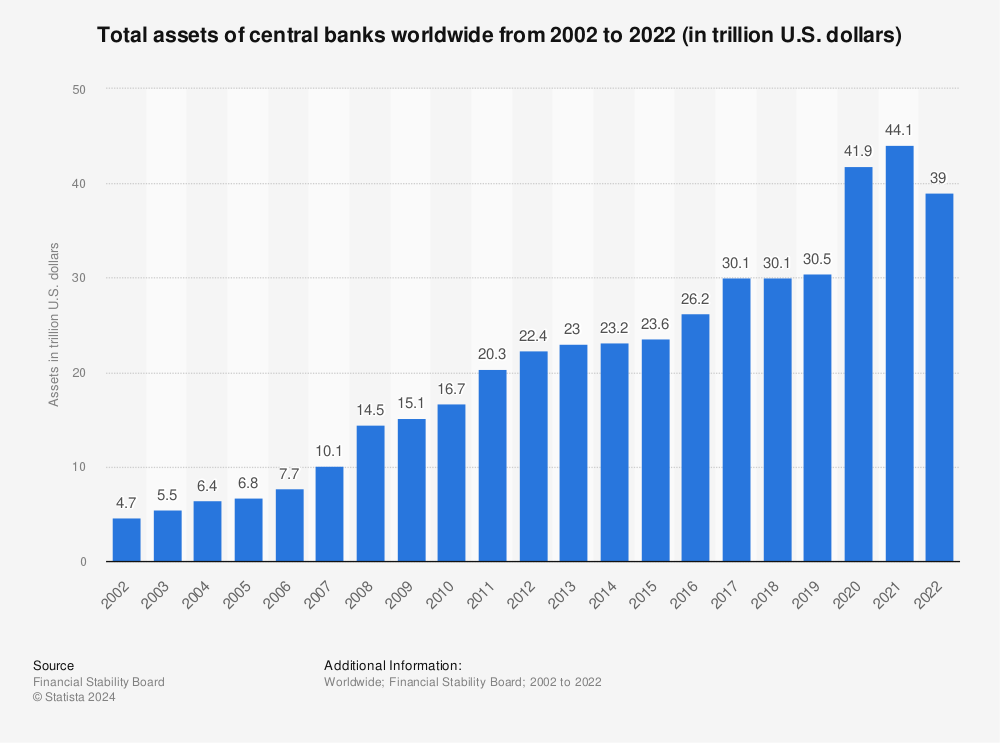

Chart of the Day

Total assets of central banks worldwide from 2002 to 2017

This statistic presents the total assets of central banks worldwide from 2002 to 2017. In 2017, the assets of central banks globally amounted to 30.1 trillion U.S. dollars.

Source: statista.com

Video of the day

Trading Concept Check: Investing vs Trading

Watch this quick video to help you make sure you understand the concept of Investing vs. Trading.

Rookie Corner

Broker Madness! The Redux!

Good Day Rookie Bloggers! We are switching things up again this week as there have been some new developments with the discount brokerages that we use. As most of you are probably aware Charles Schwab is purchasing TD Ameritrade and is basically becoming a giant brokerage firm.

Traders Lounge 11 PM EST

Join the coaches in this live lounge, ask questions, discuss ideas or just sit back and listen to veteran traders discuss market conditions.

Cashflow Club 8:30 PM EST

Held every Thursday before Friday’s option contract expirations, this show helps you perfect your favorite cashflow strategies.

Halftime Report 12:30 PM EST

The Halftime Report starts at 12:30 EST and covers what news is driving the market, chart analysis from the movers and shakers of the day and fun in a way that only Matt and Tim can deliver.

Financial freedom is a journey

The Tackle Today series is brought to you by Tackle Trading.

Sign up now and gain unfettered access to all of the quality content and powerful Scouting Reports that our Pro Members enjoy for 15-days absolutely free with no strings attached and let us show you what your trading has been missing.

# Sign up now for a 15-DAY FREE TRIAL #

Legal Disclaimer

Tackle Trading LLC (“Tackle Trading”) is providing this website and any related materials, including newsletters, blog posts, videos, social media postings and any other communications (collectively, the “Materials”) on an “as-is” basis. This means that although Tackle Trading strives to make the information accurate, thorough and current, neither Tackle Trading nor the author(s) of the Materials or the moderators guarantee or warrant the Materials or accept liability for any damage, loss or expense arising from the use of the Materials, whether based in tort, contract, or otherwise. Tackle Trading is providing the Materials for educational purposes only. We are not providing legal, accounting, or financial advisory services, and this is not a solicitation or recommendation to buy or sell any stocks, options, or other financial instruments or investments. Examples that address specific assets, stocks, options or other financial instrument transactions are for illustrative purposes only and are not intended to represent specific trades or transactions that we have conducted. In fact, for the purpose of illustration, we may use examples that are different from or contrary to transactions we have conducted or positions we hold. Furthermore, this website and any information or training herein are not intended as a solicitation for any future relationship, business or otherwise, between the users and the moderators. No express or implied warranties are being made with respect to these services and products. By using the Materials, each user agrees to indemnify and hold Tackle Trading harmless from all losses, expenses and costs, including reasonable attorneys’ fees, arising out of or resulting from user’s use of the Materials. In no event shall Tackle Trading or the author(s) or moderators be liable for any direct, special, consequential or incidental damages arising out of or related to the Materials. If this limitation on damages is not enforceable in some states, the total amount of Tackle Trading’s liability to the user or others shall not exceed the amount paid by the user for such Materials.

All investing and trading in the securities market involves a high degree of risk. Any decisions to place trades in the financial markets, including trading in stocks, options or other financial instruments, is a personal decision that should only be made after conducting thorough independent research, including a personal risk and financial assessment, and prior consultation with the user’s investment, legal, tax and accounting advisers, to determine whether such trading or investment is appropriate for that user.