Ever wonder how a billionaire hedge fund manager defines progress? I have. All the time. It’s what I think about at night when sleep eludes me and sheep counting gets boring. Fortunately, I stumbled upon the answer when listening to an interview of Ray Dalio who is the founder of a Bridgewater Associates, a hedge fund with some $150 billion under management.

You know, pocket change.

Dalio cleverly articulated his definition of progress as a formula: pain + reflection = progress. Today I wish to deconstruct the equation with the objective of identifying just how you and I can grow as traders. Remember, there’s a pot of gold at the end of the rainbow but only those who seek improvement ever attain it.

Pain

Nobody likes pain. And, unfortunately, the stock market likes to dole it out massive quantities from time to time. And when is the pain the most potent? It’s certainly not when you’re swimming in profits. I’ve never met a trader crying while counting his dough, unless they were tears of joy. It’s fair to say that on Wall Street pain is synonymous with loss. Simply put, losing trades deliver pain while winning trades grant pleasure.

And since losing trades are inevitable, for all but the most robotic of us, pain will arrive unbidden every year.

But while the presence of pain is mostly out of our control, its potency isn’t. We dictate just how much potential pain awaits at the end of every bet through our sizing. Only a dum-dum gives a single trade the power to destroy his entire investment account. Consider this little gem reason #274 for why sound risk protocols are a must.

In sum, pain and loss are synonyms.

Reflection

The second part of the equation is what makes all the difference. It’s the battery that makes the whole machine run, as it were. Everyone experiences pain, but few spend time and resources for reflection before moving onto their next adventure.

I can think of numerous questions that should be a part of the reflection phase. Chief among them is, “Was my loss because of a mistake I made or simply because the market didn’t cooperate?” Remember, not all losses (pain) can be blamed on you being an idiot. Sometimes you follow your trading plan or system perfectly, never deviating from the rules for a second, and still lose. That’s part of the game and what should be considered a good loss, or an acceptable loss. Your job in trading is to get to the point where all your losses are “good losses.”

The principal purposes of the reflection phase are to identify bad losses, those that should be considered unacceptable. By definition, a bad loss is one that arrived due to your misbehavior. Think of it as user error. The eradication of these types of trades will undoubtedly lead to progress.

So is that it? Is the reflection phase intended solely to identify bad trades?

No. A second purpose is to identify areas of improvement for your trading plan or systems. This isn’t to suggest that endless tinkering is necessary to create a perfect system. Furthermore, I don’t even know what the definition of a perfect system is. The reason we need continual reflection on our systems is that market conditions change. Wall Street is a Darwinian environment where those who refuse to adapt will suffer sub-par returns at best and end up in the graveyard at worst.

To properly reflect, you have to have your trade stats available. And that requires some type of journal. Fortunately, the Tackle Trading Journal is already programmed with the essentials. But having a record isn’t sufficient. You need to set aside time for a proper perusal of the data and identification of key takeaways. This is what I do in my monthly retrospectives, and it has improved my trading dramatically. If you’re not sure how to structure your reflection sessions, then use these as a starter guide.

Progress

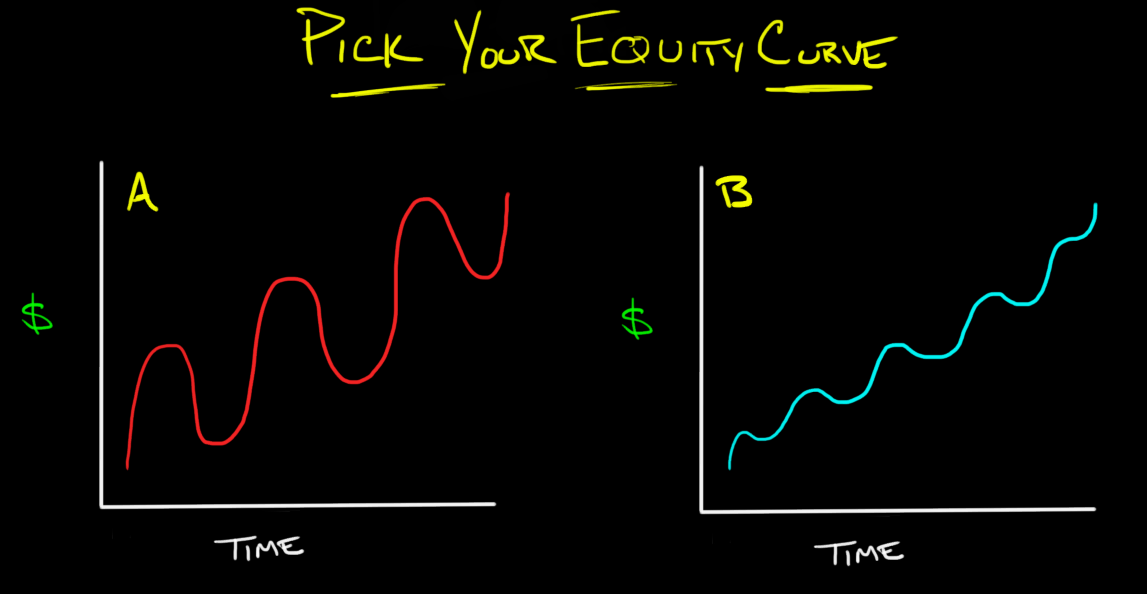

When it comes to trading, I suspect we’d all define progress as making more money. The hope, then, is that by reflecting on our pain and modifying our behavior we can generate better returns. But if put on our thinking caps we can come up with a second definition of progress. How about smoothing out our equity curve? Essentially this means we’re reducing the amount of fluctuation in our account value over time.

Elimination of gut-wrenching drawdowns will reduce your emotions and arguably increase your longevity as a trader. It’s not just the destination that matters (making more money), it’s the path you have to take to get their (your equity curve).

If the path is too volatile, you’ll quit before you reach your destination.

And fortune never favors a quitter.

Financial freedom is a journey

The Tales of a Technician series is brought to you by Tackle Trading.

Sign up now and gain unfettered access to all of the quality content and powerful Scouting Reports that our Pro Members enjoy for 15-days absolutely free with no strings attached and let us show you what your trading has been missing.

# Sign up now for a 15-DAY FREE TRIAL #

Legal Disclaimer

Tackle Trading LLC (“Tackle Trading”) is providing this website and any related materials, including newsletters, blog posts, videos, social media postings and any other communications (collectively, the “Materials”) on an “as-is” basis. This means that although Tackle Trading strives to make the information accurate, thorough and current, neither Tackle Trading nor the author(s) of the Materials or the moderators guarantee or warrant the Materials or accept liability for any damage, loss or expense arising from the use of the Materials, whether based in tort, contract, or otherwise. Tackle Trading is providing the Materials for educational purposes only. We are not providing legal, accounting, or financial advisory services, and this is not a solicitation or recommendation to buy or sell any stocks, options, or other financial instruments or investments. Examples that address specific assets, stocks, options or other financial instrument transactions are for illustrative purposes only and are not intended to represent specific trades or transactions that we have conducted. In fact, for the purpose of illustration, we may use examples that are different from or contrary to transactions we have conducted or positions we hold. Furthermore, this website and any information or training herein are not intended as a solicitation for any future relationship, business or otherwise, between the users and the moderators. No express or implied warranties are being made with respect to these services and products. By using the Materials, each user agrees to indemnify and hold Tackle Trading harmless from all losses, expenses and costs, including reasonable attorneys’ fees, arising out of or resulting from user’s use of the Materials. In no event shall Tackle Trading or the author(s) or moderators be liable for any direct, special, consequential or incidental damages arising out of or related to the Materials. If this limitation on damages is not enforceable in some states, the total amount of Tackle Trading’s liability to the user or others shall not exceed the amount paid by the user for such Materials.

All investing and trading in the securities market involves a high degree of risk. Any decisions to place trades in the financial markets, including trading in stocks, options or other financial instruments, is a personal decision that should only be made after conducting thorough independent research, including a personal risk and financial assessment, and prior consultation with the user’s investment, legal, tax and accounting advisers, to determine whether such trading or investment is appropriate for that user.

One Reply to “Tales of a Technician: Ray Dalio and the Progress Formula”

Great post, Tyler!!! Thank you.

Comments are closed.