Options Theory: 3 Ways to Play the Growth Stock Carnage

January 13, 2022

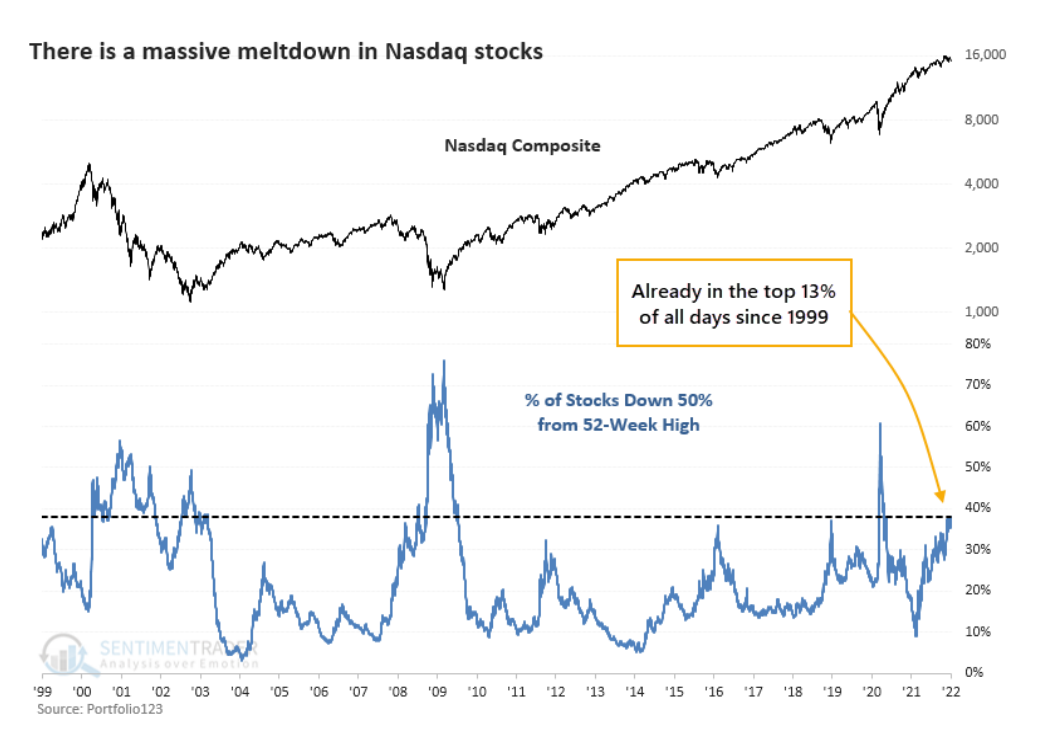

We’re witnessing a market of great disparity. On the one hand, you have sectors like energy, financials, basking near 52-highs. On the other hand, growth stocks are getting destroyed. Did you know that 4 out of every 10 stocks in the Nasdaq have fallen 50% or more from their one-year highs?

Check out this humdinger of a chart from @sentimentrader

Of course, because the Nasdaq Composite Index is market-cap weighted you don’t really see the bloodbath. Even after Thursday’s whack, QQQ is still only 7.6% off the high. But, again, underneath the surface, it’s a completely different story. I’ve been using (and will continue to use) the Ark Innovation ETF (ARKK) as my go-to proxy for high beta growth stocks. It just fell to a new one-year low and looks disgusting.

So what’s a smart, tactical trader to do with this information? I can think of a few things.

First, if you’re a believer in trend continuation (which you better be if you use technical analysis!) then, for heaven’s sake, steer clear of deploying bullish trades in the growth space. It’s a horror show and could get worse before it gets better. Instead, focus your attention on the areas that are leading, like XLE, XLF, XLP, and the like.

Second, heed the mantra, “if you can’t beat ’em, join ’em.” Look for bearish trades in growth stocks. Here are three examples.

Mega-caps will Succumb

QQQ formed a lower pivot high with yesterday’s decline and continues to flash warning signs. If you think the big boys will prove unable to reach a new high for the next month then consider bear call spreads. Consider this the highest probability idea of today.

Sell the Feb $405/$410 call vertical for 55 cents.

The Sinking Arkk

I’ve pitched bear trades on ARKK in the past during my Wednesday Trade Masters competition on YouTube. And while it’s tempting to say ARKK can’t go any lower because it’s already down 50% from its highs, the reality is this sucker could fall way more. If you want to bet on more growth stock pain without picking an individual company, then bear spreads on ARKK make sense.

To offer some variety, let’s go with a lower probability spread with a higher payout potential.

Buy the March $80/$69.22 put vertical for $4.

Pick a Puker

The final option for profiting is to pick one of the dozens of struggling growth stocks. Since they were the biggest losers on Thursday, how about simply sorting your watchlist by percentage change and viewing the charts of those that top the list?

The correlation between them is so high, I’m not even sure it matters all that much which one you pick. As long as growth is out of favor, you should be fine. That said, here’s an example on Rivian (RIVN).

Buy the March $80/$65 put vertical for $6.40.

Read more Options Theory [FREE Content]

Every Thursday our resident options addict, Tyler Craig, will be at the helm to help you demystify derivatives and better understand what truly makes them tick. Options for beginners? Come this way, please. Enlightenment awaits.

Financial freedom is a journey

Sign up now and gain unfettered access to all of the quality content and powerful Scouting Reports that our Pro Members enjoy for 15-days absolutely free with no strings attached and let us show you what your trading has been missing.

Legal Disclaimer

Tackle Trading LLC (“Tackle Trading”) is providing this website and any related materials, including newsletters, blog posts, videos, social media postings and any other communications (collectively, the “Materials”) on an “as-is” basis. This means that although Tackle Trading strives to make the information accurate, thorough and current, neither Tackle Trading nor the author(s) of the Materials or the moderators guarantee or warrant the Materials or accept liability for any damage, loss or expense arising from the use of the Materials, whether based in tort, contract, or otherwise. Tackle Trading is providing the Materials for educational purposes only. We are not providing legal, accounting, or financial advisory services, and this is not a solicitation or recommendation to buy or sell any stocks, options, or other financial instruments or investments. Examples that address specific assets, stocks, options or other financial instrument transactions are for illustrative purposes only and are not intended to represent specific trades or transactions that we have conducted. In fact, for the purpose of illustration, we may use examples that are different from or contrary to transactions we have conducted or positions we hold. Furthermore, this website and any information or training herein are not intended as a solicitation for any future relationship, business or otherwise, between the users and the moderators. No express or implied warranties are being made with respect to these services and products. By using the Materials, each user agrees to indemnify and hold Tackle Trading harmless from all losses, expenses and costs, including reasonable attorneys’ fees, arising out of or resulting from user’s use of the Materials. In no event shall Tackle Trading or the author(s) or moderators be liable for any direct, special, consequential or incidental damages arising out of or related to the Materials. If this limitation on damages is not enforceable in some states, the total amount of Tackle Trading’s liability to the user or others shall not exceed the amount paid by the user for such Materials.

All investing and trading in the securities market involves a high degree of risk. Any decisions to place trades in the financial markets, including trading in stocks, options or other financial instruments, is a personal decision that should only be made after conducting thorough independent research, including a personal risk and financial assessment, and prior consultation with the user’s investment, legal, tax and accounting advisers, to determine whether such trading or investment is appropriate for that user.