There is perhaps no better ETF to track the true carnage transpiring in the marketplace than the Ark Innovation Fund (ARKK). Since November 4th, a mere one month ago, the fund has fallen 29%. If you go back further to its February peak, it’s down 44%. Were we in the midst of a historic bear market, then perhaps the descent would be forgivable. But the S&P 500 is a mere 4.2% from its peak! We’re talking about some serious underperformance.

Last year, Ark’s outspoken leader, Cathie Wood, rode an outsized bet in Tesla to the moon and attracted legions of followers in the process. The fund’s holdings include the who’s who of massive market winners following the pandemic. Or at least, they were monster winners before this year’s unraveling.

We’re talking Tesla, Zoom, Teladoc Health, Roku, Twilio, DocuSign, Square, and the like.

If you want to know just how bloodied the fund has gotten, how about this gem of a stat from @PensionCraft on Twitter,

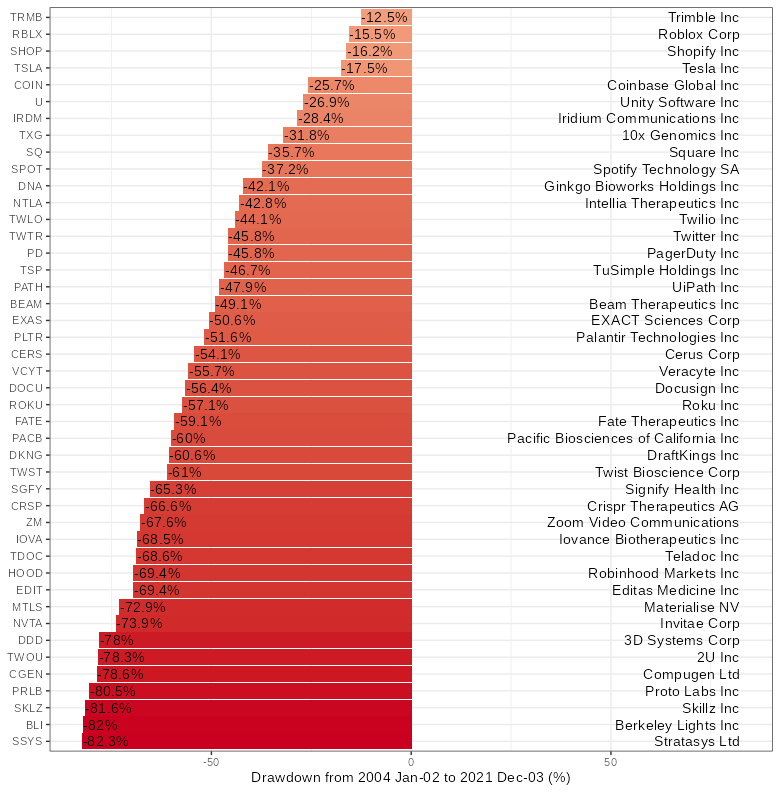

“There’s a bear market for all but 4 stocks in Cathie Wood’s ARKK fund. Is this a buying opportunity or were these just overpriced stocks in a period of euphoria?”

The fund’s investment theme is disruptive innovation. And most companies that fall under that banner are high-growth, high beta stocks. Unfortunately, it is the exact area that has suffered the most over the past month. Consider it the epicenter of all that ails the broad market right now.

As such, it’s been an important ETF to follow as a tell for the market mood. Here’s the one-year chart:

The desperately oversold conditions have the stock begging for a bounce. And while I’ve seen plenty of failed hammer candles, I’d be lying if I didn’t say Monday’s formation didn’t have me optimistic. Volume patterns support a rebound attempt here as well. Remember, volume tends to crescendo at the end of a move. It signals capitulation, or a lot of shareholders finally calling it quits and abandoning ship.

Note the swell in participation on Friday and today. While it’s far too soon to call a bottom in the downtrend, it certainly seems like we might have seen a bottom in the down swing. If that’s the case, and I hope it is, it could aid a multi-day bounce in the broad market. We’ve been stuck in ping-pong purgatory in the S&P 500 with up days being immediately followed by down days. If equities can hold onto Monday’s gains and add to them tomorrow, it could finally signal a change in character.

Is There a Trade on ARKK?

Maybe. Here are the next two potential setups.

First, we do have a Fade the Fear pattern right now. The stock is oversold and Implied volatility has blasted sky-high. We just saw a bullish reversal candle that provides some confirmation that a rebound has begun. Obviously, you’d have to be comfortable deploying a counter-trend trade to play here.

The idea would be selling far OTM bull put spreads, such as the Jan $75/$70 bull put for 50 cents.

If you’d rather go with the trend then you’re waiting for this bounce to morph into a bear retracement. Ideally, we bounce for a few days (3 to 5) and then form a lower pivot high. Then you could enter something bearish such as a bear call or bear put.

Read more Tales of a Technician [FREE Content]

Financial freedom is a journey

Sign up now and gain unfettered access to all of the quality content and powerful Scouting Reports that our Pro Members enjoy for 15-days absolutely free with no strings attached and let us show you what your trading has been missing.

Legal Disclaimer

Tackle Trading LLC (“Tackle Trading”) is providing this website and any related materials, including newsletters, blog posts, videos, social media postings and any other communications (collectively, the “Materials”) on an “as-is” basis. This means that although Tackle Trading strives to make the information accurate, thorough and current, neither Tackle Trading nor the author(s) of the Materials or the moderators guarantee or warrant the Materials or accept liability for any damage, loss or expense arising from the use of the Materials, whether based in tort, contract, or otherwise. Tackle Trading is providing the Materials for educational purposes only. We are not providing legal, accounting, or financial advisory services, and this is not a solicitation or recommendation to buy or sell any stocks, options, or other financial instruments or investments. Examples that address specific assets, stocks, options or other financial instrument transactions are for illustrative purposes only and are not intended to represent specific trades or transactions that we have conducted. In fact, for the purpose of illustration, we may use examples that are different from or contrary to transactions we have conducted or positions we hold. Furthermore, this website and any information or training herein are not intended as a solicitation for any future relationship, business or otherwise, between the users and the moderators. No express or implied warranties are being made with respect to these services and products. By using the Materials, each user agrees to indemnify and hold Tackle Trading harmless from all losses, expenses and costs, including reasonable attorneys’ fees, arising out of or resulting from user’s use of the Materials. In no event shall Tackle Trading or the author(s) or moderators be liable for any direct, special, consequential or incidental damages arising out of or related to the Materials. If this limitation on damages is not enforceable in some states, the total amount of Tackle Trading’s liability to the user or others shall not exceed the amount paid by the user for such Materials.

All investing and trading in the securities market involves a high degree of risk. Any decisions to place trades in the financial markets, including trading in stocks, options or other financial instruments, is a personal decision that should only be made after conducting thorough independent research, including a personal risk and financial assessment, and prior consultation with the user’s investment, legal, tax and accounting advisers, to determine whether such trading or investment is appropriate for that user.